Expanding the Investment Environment for Clean Energy Through New Financial Vehicles

Apex identifies unique financial solutions, such as the proxy revenue swap, to manage energy risk for its investors.

This past summer, Apex closed on the joint financing for the Cotton Plains Wind, Old Settler Wind, and Phantom Solar energy facilities, all located in Texas. One of the many unique features of the transaction was our employment of a novel financial hedge product called a proxy revenue swap, or PRS, for Old Settler Wind. Without the economic certainty that the PRS brings to that project, Apex would not have been able to source the roughly $330 million in debt and equity capital necessary to build and operate the facilities. But because the PRS was relatively new and not well understood in the financial markets, its presence at Old Settler presented unique challenges during the financing process.

Innovation Expands Investment Opportunities

Financial hedges are not new to the energy industry. A more common version, often called a fixed-for-floating swap, is well understood in the market. In a typical fixed-for-floating swap, a project will sell the electricity it generates into the spot, or merchant, market. The price of energy in the spot market is in constant flux, and in certain circumstances can fluctuate wildly from hour to hour. The vast majority of project financing parties will not invest in a project selling power into the spot market because they are uncomfortable with the cash flow instability, which increases the uncertainty that their investment will be repaid. To counter this risk and make the project more attractive to financing parties, the project owner will enter into an agreement with a counterparty—typically a bank or an energy company—whereby the counterparty will agree to pay the project a fixed price for energy generated by the project, in return for the value that the project receives from the spot market. For instance, let’s say Old Settler Wind agreed to a swap at a price of $30 per megawatt-hour (MWh). Then, if Old Settler were to sell one MWh into the ERCOT market at $20, it would transfer this $20 to the swap counterparty, and the swap counterparty would transfer $30 back to Old Settler. Likewise, if the MWh sold for $35, the project would send $35 to the swap counterparty, and the swap counterparty would still send $30 back to Old Settler. Thus, the project is swapping the “floating” price received for that MWh (i.e., $20 or $35) for the fixed price of $30. This arrangement allows the project to rely on a steady cash flow—$30/MWh—which investors can rely on when calculating their expected investment return.

Eliminating Wind Production Risk to Enhance Deal Value

Under a traditional fixed-for-floating swap, however, the swap counterparty will not take a position on how many MWh a project is expected to produce (in other words, they do not want to take the risk relating to the productivity of the wind resource). To avoid this, traditional swap counterparties will only agree to swap the P99 volume produced by the project (that is, the MWh that a project can be expected to produce with 99% certainty). As a result, all of the energy that a project generates above the P99 generation level is not subject to the swap; this energy is sold into the spot market without the benefit of a fixed price. Because most investors place a lower value on the energy that does not have a guaranteed price, they discount this post-P99 production when sizing their investment amount. Depending on the specifics at a particular wind project, the amount of post-P99 production can be considerable, and failing to account for this production can lead to a dramatically reduced investment from financing parties.

The PRS takes wind production risk off the table. This results in more guaranteed revenue for the project, thus allowing the project to finance a greater portion of its capital costs.

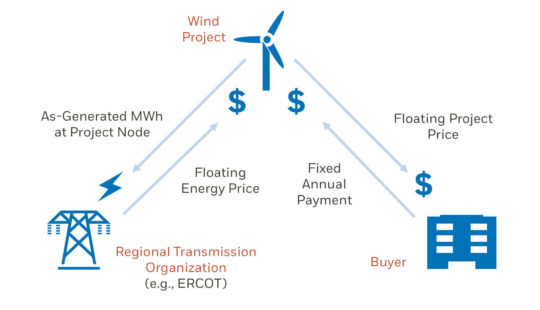

Enter the proxy revenue swap. At its core, the PRS guarantees a project a fixed amount of revenue, regardless of how many MWh the project actually produces. Thus, even if the wind doesn’t blow for an entire year—and likewise the wind farm doesn’t generate any electricity—the project will still receive revenues from the PRS counterparty. In return, the project will turn over all the revenues that it actually receives from selling its energy into the spot market over that same period of time. The amount of revenue guaranteed under a PRS is primarily a function of the counterparty’s evaluation of the project’s wind profile (PRS counterparties are often insurance companies with experience evaluating weather-related risk).

Put simply, a traditional fixed-for-floating swap takes price risk off the table. The PRS takes this concept one step further by also taking wind production risk off the table. This results in more guaranteed revenue for the project, thus allowing the project to finance a greater portion of its capital costs.

Although the PRS counterparty is comfortable taking price risk and wind risk, it does not take operations or basis risk—those stay with the project. In oversimplified terms, operations risk is the risk that the project will not convert wind into electricity as efficiently as expected due to operational issues such as turbine maintenance. Basis risk is the risk that the electricity price at the “hub”—where electricity is traded on the spot market—will be less than the electricity price at the actual location, or “node,” where the electricity enters the grid. (Basis is a complicated topic beyond the scope of this article, but the most common reason for differences in hub and node prices is inadequate transmission.)

Putting the PRS to the Test

The novelty and complexity of the PRS came into focus when Apex began the financing process. Investors tend to prefer projects and concepts that are well understood—no one wants to lend money on the basis of a new product that turns out to be fundamentally flawed. For this reason, each of the sponsor equity, debt, and tax equity investors undertook a detailed review of the PRS and insisted on being fully satisfied with its risk profile prior to funding. Unlike the vast majority of their investments, the investors had no previous experience with this product; they had to learn everything from scratch. The detailed review included analysis by multiple independent engineers, consultants, and law firms, as well as the investors’ in-house legal, accounting, and engineering teams.

This painstaking due diligence process placed a substantial burden on Apex. Many of my colleagues in the asset management, power marketing, resource assessment, and legal departments will recall a seemingly endless series of conference calls to explain how the PRS works and to structure the transaction to fit the needs of the investors. All of this was in service of helping five different investors complete their diligence and commit their share of roughly

$330 million in capital costs. At the end of the process, our financing efforts were successful, and the Cotton Plains Wind, Old Settler Wind, and Phantom Solar projects are now under construction.

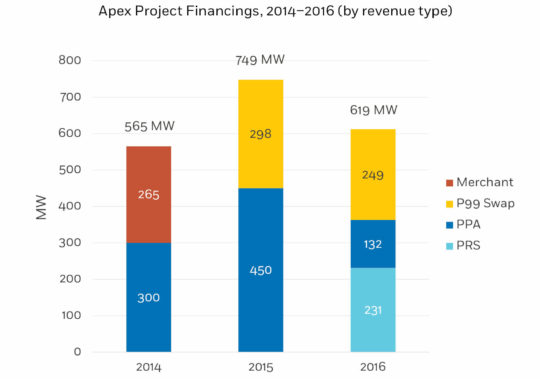

(Note: 2016 financings are as of October 1.)

Benefits of the PRS

A long-term power purchase agreement (PPA) with an investment-grade counterparty remains the gold-standard revenue option for financing a wind project. Apex’s power marketing team has been actively searching for alternative revenue sources capable of standing up to the scrutiny of the financing process. Apex successfully closing on the financing for the trio of Texas projects in July 2016 demonstrates that the PRS fits this mold.

In fact, the PRS has already become a powerful asset in our power marketing toolbox. Shortly after closing on the hybrid portfolio, we successfully incorporated a PRS for a portion of the generation at our Grant Plains Wind project in Oklahoma, which closed in August and is currently under construction.

And Apex is now actively modeling the PRS at many of our other projects. We believe the PRS will remain a viable path to market complementing traditional PPAs and financial hedges, and we expect the PRS financing process to become smoother as we apply the lessons learned from these recent projects.