Aggregation Expands the Market for the Fortune 500 and Beyond

Wind and Solar Projects Bring Corporates Together to Purchase Clean Power

Demand for renewable energy products has never been stronger. More than 240 companies have committed to purchase 100% of their energy from renewable sources—and that’s not counting those with broader sustainability goals that include renewable procurement. Within companies that run the gamut—IKEA, eBay, Starbucks, Smithfield—priorities are aligning around clean energy as a means of combatting one of the defining issues of our time: climate change.

Take a look at the list of RE100 members who have committed to 100% renewable power. It raises the question: How does this community grow from the Fortune 500 to the Fortune 5000?

Part of the answer lies in aggregation.

The Evolution of Aggregation

Aggregating power purchasing is nothing new. Back in 2011, Apex negotiated its first two power purchase agreements (PPA), combining demand from Oklahoma Municipal Power Authority and American Electric Power for the output of Canadian Hills Wind. At the hundreds-of-megawatts scale of utility-scale wind and solar projects, most power buyers either don’t need the entire output of a project or prefer to spread their procurement across multiple assets and regions.

But as the industry has matured and new types of renewable energy purchasers entered the market, aggregation has taken on new significance.

Nearly a decade after signing its first PPAs, Apex is now aggregating utility, corporate, and financial offtake agreements across our projects. Between Apex’s extensive power market expertise, the expanding number of new buyers, and the efforts of advisers educating offtakers, the independent, lengthy, and often laborious negotiations of years past have been streamlined. On the other side of the table, corporate power purchasers are discovering that teaming up offers significant advantages—no matter who they are.

Aggregation allows small purchasers who can’t absorb the capacity of a full project to still access competitive pricing and favorable terms and conditions. Large buyers operating across the country can diversify their risk to energy markets, whether in generation type or location, spanning multiple regional transmission organizations. Industry-leading corporations are beginning to encourage their supply chains to also procure clean energy—therefore making their own sustainability claims stronger by accounting for carbon throughout their products’ life cycle.

Today, power buyers are uniting to leverage their collective purchasing experience, realize economies of scale, and boost their negotiating power—all while achieving customized solutions as parties with individual needs within the aggregated agreements. Company-specific priorities, whether that’s size, location, or other commercial terms, can be achieved within the framework of a collective PPA. And for developers, the nearly identical contract language simplifies related operational and financial work. It’s a win-win from all perspectives.

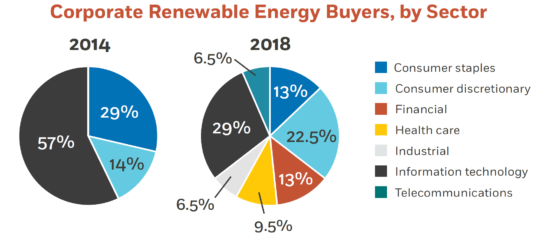

As the industry continues to offer competitive solutions and aggregate demand, a broader, more diverse group of buyers will access the market.

Apex’s White Mesa Wind, a 500 MW project located in Crockett County, Texas, is a prime example. The project, expected to begin operations in 2021, will sell renewable power to a number of iconic corporate brands via an aggregated agreement, and Apex has continued to sign PPAs with additional offtakers as the project progresses.

The Future of Power Purchasing

Already, aggregated PPAs have expanded the market, enabling new corporate entrants to procure clean power and bringing new wind and solar projects onto the grid. But there’s still plenty of untapped potential as we look to aggregation as a renewable energy solution.

As power purchasing continues to evolve, more and more customers are seeking clean energy solutions for the first time. In the future, gaining a clear understanding of that demand will enable Apex to aggregate more intelligently. Whether your company prioritizes location, technology, impact—or another attribute of renewable projects—Apex can pair commercially similar needs to accelerate purchasing and renewable deployment with the support of corporations.

Visualizing demand has additional implications that would also open the marketplace to new buyers. Currently, Apex and our peers invest millions of dollars in developing projects without the certainty that an offtaker—or two or three—will ultimately purchase the power. That uncertainty translates to development risk, which can transfer to more conservative PPA terms and conditions. By developing a clear understanding of where and when purchasers will seek new renewable energy, developers can invest in the right projects in the right place at the right time—thereby reducing risk and ultimately, reducing the hurdles for private and public sector climate goals to be achieved. As the industry continues to offer competitive solutions and aggregate demand, a broader, more diverse group of buyers will access the market.

As we look to the future of power procurement, one thing is certain: the industry will see more intentional and intelligent demand aggregation—the pathway to bringing renewable energy to the RE100, the Fortune 5000, and beyond.